Lendroid — A Decentralized Digital Asset Lending Platform

Introduction

Lendroid is a trustless, open, peer to peer digital asset lending platform based on the Ethereum blockchain. The Lendroid marketplace enables borrowers to avail instant low-cost digital asset loans and lenders to earn interest on the digital assets they lend. Additionally, Lendroid support token (LST) holders act as guarantors of these loans by locking up their LSTs as secondary collateral. The Lendroid platform is extensible by design and allows the creation of loan markets on any ERC20 token.

What Lendroid Offers

Lendroid is a trustless, open, peer to peer digital asset lending platform based on the Ethereum blockchain.

The Lendroid marketplace enables borrowers to avail instant low-cost digital asset loans and lenders to earn interest on the digital assets they lend. Additionally, Lendroid support token (LST) holders act as guarantors of these loans by locking up their LSTs as secondary collateral. The Lendroid platform is extensible by design and allows the creation of loan markets on any ERC20 token.

Lendroid seeks to overcome on-chain limitations of latency and impractical gas cost by creating a symbiotic off-chain infrastructure supported by incentivized participants. The native token keeps the network operational, fuels the utility layer of the protocol and offers security to community governance. The ecosystem nurtures a decentralized, global, shared lending pool.

1. Non-Rent-Seeking Protocol

Lendroid is non-rent-seeking, where all transaction throughput goes to the off-chain utility actors — the 0x based Relayers and the newly introduced Wranglers — who coordinate to make the network stable.

2. Trust-Independent and Autonomous

Smart contracts ensure no custodianship of user funds, thus mitigating counterparty risks. This lets users and off-chain keepers manage their operations without being controlled by a central authority

3. Interoperability and Shared Liquidity

Supports multiple exchanges and is compatible with exchange protocols, thus contributing to a global shared liquidity pool. Lenders facilitate a global shared lending pool thereby enhancing lending liquidity.

How Lendroid works?

A loan contract itself is pretty straight forward. But then, who fixes the terms of the loan? How do borrowers find and convince lenders? How do we make sure the borrower has the incentive to repay? What happens if the borrower fails to repay? etc

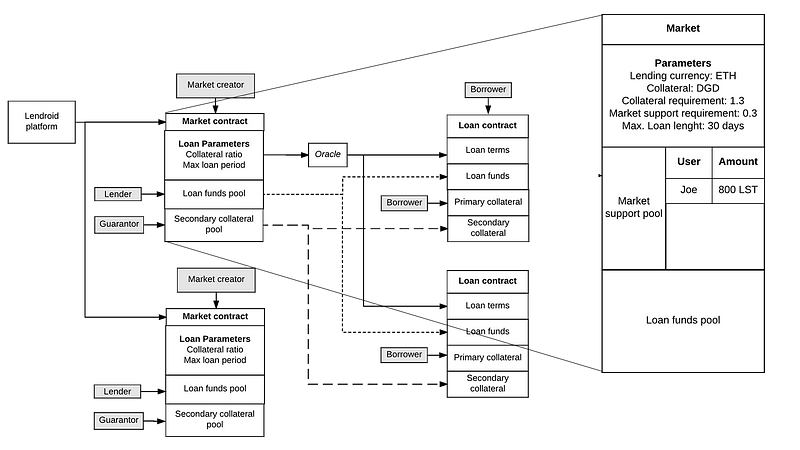

The Lendroid marketplace allows the creation of several loan markets.

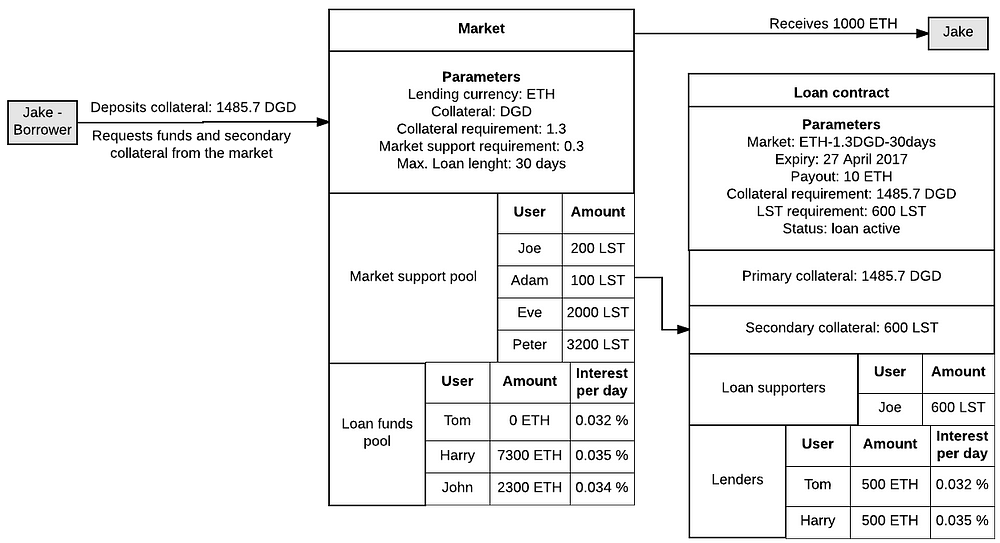

Lendroid support tokens(LST) are the native tokens of the Lendroid protocol. Market creators (Lendroid support token holders) propose new markets using a unique set of loan terms (combination of collateral type and ratio).

Lenders and guarantors discover, gather and pre-fund markets which offer loan terms they prefer (terms that they believe will keep the loan solvent, protect their investment and enable them to make money). Guarantors are LST holders who choose to extend support to markets that issue loans that they believe will remain solvent and payout properly, in which case they receive a portion of the interest. If the loan becomes insolvent, they stand to lose their deposit. It is a requirement for every loan to hold LSTs whose value is at least 20% of the borrowed value. The LST deposit acts as secondary collateral for the loan.

Borrowers show up, choose a market depending on the type of collateral they wish to lock, create a loan contract, deposit collateral as defined by the terms of the loan and receive the loan funds.

At the end of the loan period, the borrower has the option to extend the loan by adjusting the collateral locked or repay the loan along with the accrued interest, or stands to lose their collateral.

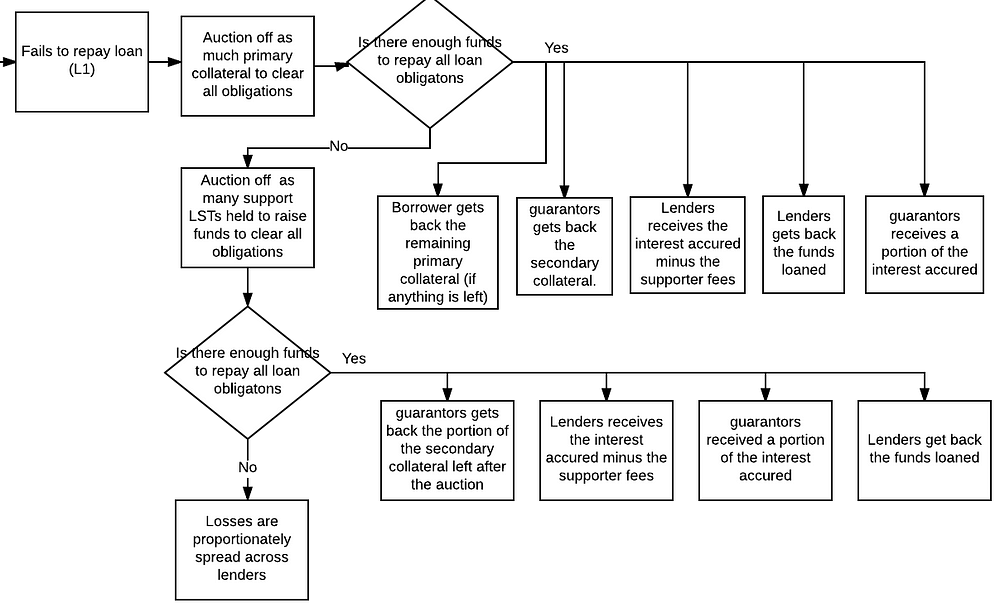

If the borrower fails to repay the loan, the primary collateral held in the loan in auctioned off. If the funds raised in the auction is insufficient to clear all obligations as much secondary collateral (Lendroid support tokens) is auctioned off to raise additional funds. If even after auctioning off all secondary collateral locked in the loan there are not enough funds to repay all the lenders, the losses get spread proportionately across all lenders, and the lenders are paid out.

The lenders receive two layers of protection for the funds they lend. One from the value of the primary collateral and another from the value of the secondary collateral. This process increases the confidence of lenders and reduces the lender’s market discovery burden.

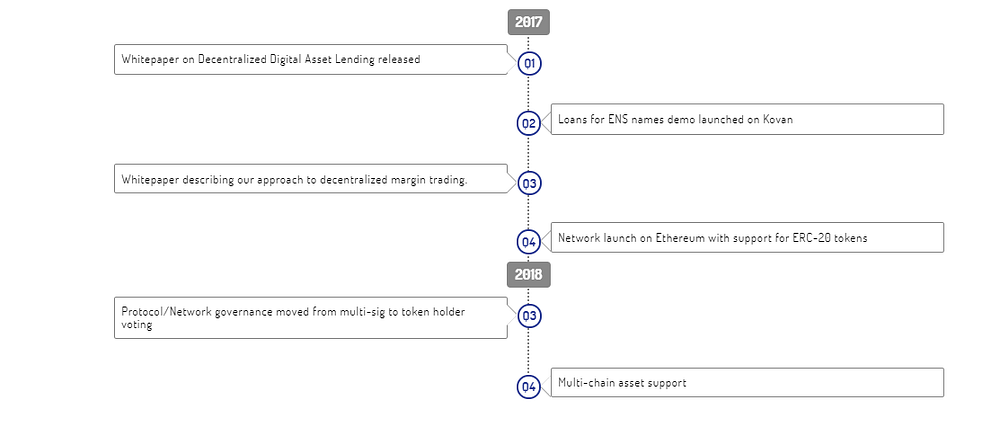

Roadmap

Details Information

Website : https://lendroid.com/

Whitepaper : https://lendroid.com/assets/whitepaper.pdf

Twitter : https://twitter.com/lendroidproject

Telegram : https://t.me/lendroidproject

My Profile Bitcointalk : https://bitcointalk.org/index.php?action=profile;u=1273699

Komentar

Posting Komentar