INS — FIRST GLOBAL DECENTRALIZED ECOSYSTEM DIRECTLY CONNECTING GROCERY MANUFACTURERS AND CONSUMERS

INTRODUCTION

GROCERY MARKET CHALLENGES

The global grocery industry is dominated by mass-market retail chains. At the national level in many countries, a large share of the grocery market is frequently in the hands of few retailers. While some amounts of buyer power are understandable and simply desirable for competitive advantage, the high level of concentration causes a growing imbalance of buyer power within the supply chain.

Exerting buyer power is natural when not abused. It is understandable that any industry participant would seek bigger volumes as a tool for negotiating better prices. But retailers push the limits of what is fair. Grocery retailers are perpetually and aggressively extracting better terms from already squeezed manufacturers, going far beyond the benefits a player should receive for attaining economies of scale.

Large or small, no manufacturer has enough power. Global constituents, such as Procter & Gamble, Nestle, and Unilever, do play a role in the industry and have more negotiating power than small manufacturers. Still, these companies simply are no match for the extensive control retailers have on end-customers throughout the supply chain. For example, Wal-Mart’s sales areapproximately 5 times greater than those of its largest supplier, Procter & Gamble.5 Wal-Mart accounted for 16% of Procter & Gamble sales in 2016

Retailer buyer abuse extends beyond normal pressure . The explanation of this pressure is abuse of buyer power. Such power allows retailers to determine what will and will not be stocked, and on what terms, such as sources, quantity, quality, delivery schedules, packaging, returns policy, and above all, price and payment conditions. Indeed, a supermarket company wields an important bargaining chip, namely the threat to stop selling one or more products.

Evidence of retail power abuse — The Competition Commission in the UK, for example, did find that major retailers enjoy a price advantage that exceeds the cost difference. Additional departures from proper retail conduct included: delaying payments to manufacturers beyond the terms in the contracts; and changing quantities or product-quality specifications at less than three days’ notice, and without paying compensation to manufacturer.7 The figure below offers specific evidence of retail buyer power abuse and lack of adherence to codes of conduct, which was covered in various news outlets.

HOW INS WORK?

FOUNDERS’ EXPERIENCE

INS founders gained a first-hand and practical experience in the grocery industry while developing and growing Instamart, the largest venture-backed grocery delivery operator in Russia. Instamart employs over 200 people, has signed contracts with the largest retailers in the country, and works with the leading grocery manufacturers.

Four years of operating experience in the grocery retail sector helped to identify major inefficiencies and abuses in the industry’s current construct. INS pursue a large opportunity to disrupt the global grocery retail market via establishing a decentralized and fair ecosystem that directly connects manufacturers and consumers.

Instamart’s select corporate customers

Instamart developed direct relationship with manufacturers, including the world’s largest multinational FMCG companies. The company has launched a number of marketing projects aimed at direct communication between the brands and consumers, including ad banners, sponsored deliveries, traffic generation, sampling and co-branded packaging.

Instamart has attracted some of the most experienced investors with exceptional track-record in tech and the grocery industry

PRODUCT SEARCH

The decentralized file storage network (we explore different options from IPFS to Storj) is used to maintain up-to-date databases of products listed by manufacturers. Consumers can apply sorting and filters to choose what they want to buy. Manufacturers may distribute proprietary apps derived from the reference implementation, in which they can choose specific sorting methods and filters for products.

68% of consumers that shopped online say they are very likely to switch grocers for a better

online shopping experience (quick, easy, convenient, enjoyable) . Browsing tens of thousands of products online can be very daunting for consumers, so we will make it as easy as possible for them to find the products that they love. For instance, we will provide catalogue filters for item attributes such as Local, Gluten-Free, Organic and On Sale.

We will use the 1-to-1 personalization right from the homepage where consumers should feel that the experience has been tailored specifically to them. Consumers will see their previous orders, have access to their most frequently purchased items, and be shown products and specials that are relevant based on their shopping history. The 1-to-1 personalization will extend to search results, the products displayed at the top of each department, product recommendations in the cart, and daily/weekly offers.

TOKEN SALE

Start date: 11:00 AM (GMT) on DECEMBER 4, 2017

Payment methods: BTC, ETH, LTC, DASH, USD (bank transfer)

Soft cap: 20,000 ETH

Hard cap: 60,000 ETH

Token exchange rate: 1 ETH = 300 INS tokens

Total token supply (max): 50,000,000

Min purchase: 0.1 ETH

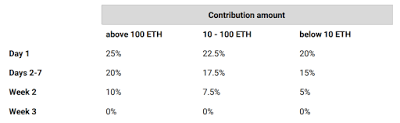

Bonuses :

- The exact number of tokens generated depends on the amount of funds contributed

- No token creation, minting or mining after the end of the ICO period

- Tokens will be transferable once the ICO is completed

- If the soft cap is not reached, funds will be returned to the participants

- Upon reaching the hard cap, the ICO will end immediately

TEAM INS

Details Information :

Website : https://ins.world/

Whitepaper : https://ins.world/INS-ICO-Whitepaper.pdf

Facebook : https://www.facebook.com/ins.ecosystem/

Twitter : https://twitter.com/ins_ecosystem

Telegram : https://t.me/ins_ecosystem

My Profile Bitcointalk : https://bitcointalk.org/index.php?action=profile;u=1273699

Komentar

Posting Komentar