Forty Seven Bank — We are connecting financial worlds

What is Forty Seven Bank ?

Forty Seven is a unique project built to create a modern universal bank both for users of cryptocurrencies and adherents of the traditional monetary system; a bank that will be acknowledged by international financial organisations; a bank that will correspond to all the requirements of regulators.

Mission of Forty Seven Bank

Forty Seven Bank is a bridge capable of connecting two financial worlds and establishing efficient communication between them, a communication that will open up possibilities to level up the whole modern financial system.

Vission of Forty Seven Bank

Forty Seven Bank is a bridge capable of connecting two financial worlds and establishing efficient communication between them, a communication that will open up possibilities to level up the whole modern financial system.

Our Values are :

=> Transparency;

=> Financial stability;

=> Effectiveness and user firendly procedures;

=> Security and privacy (data protection);

=> Innovativeness;

=> Customer satisfaction;

=> Market share growth and worldwide expansion;

=> Profit for all stakeholders.

Products and Services

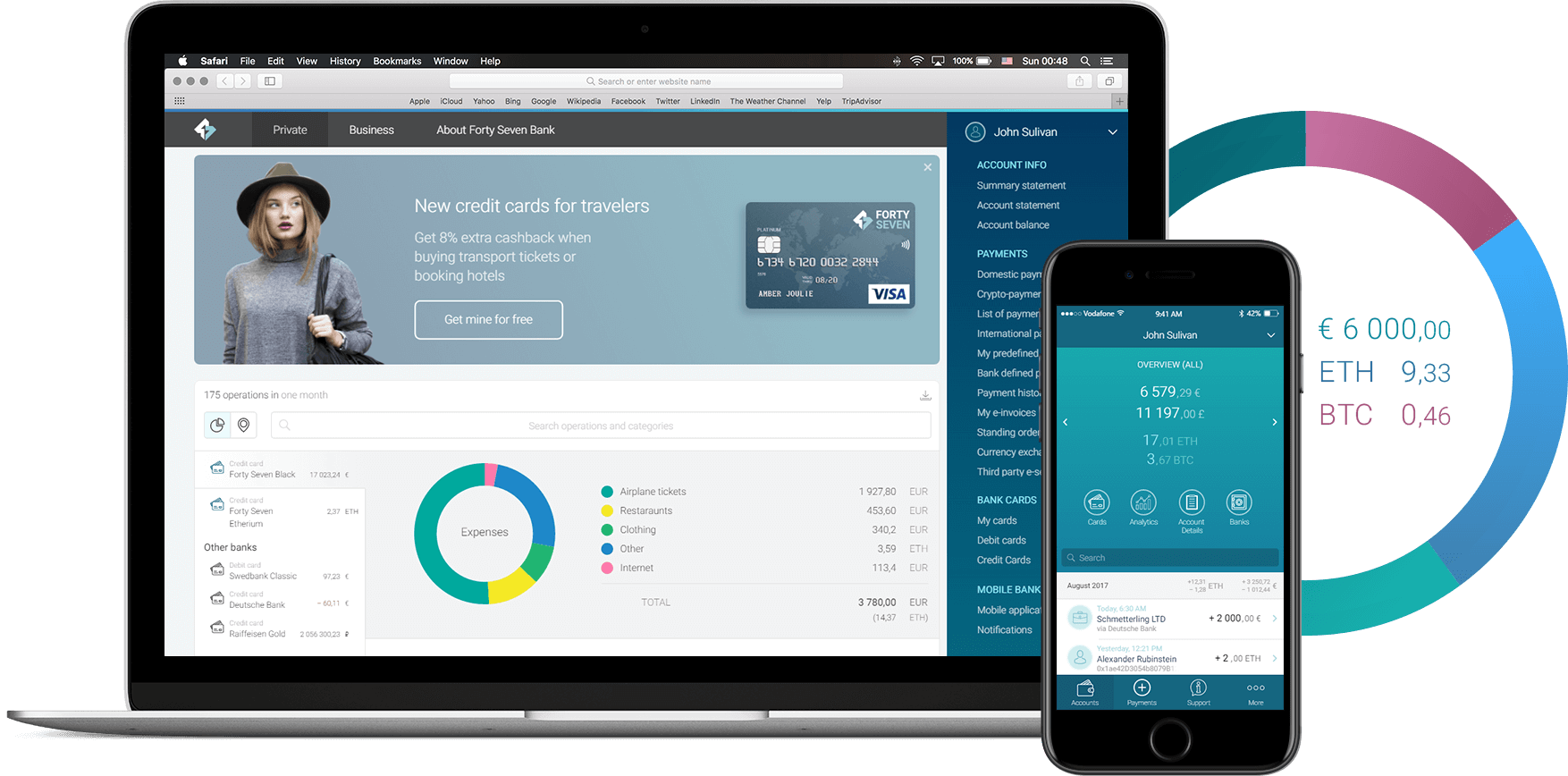

Forty Seven Bank is aiming to provide broad traditional and digital financial products and services spectrum for individual clients.

In the past, Customer Relationship Management (CRM) has changed approach to the business and customer service.We believe that smart contracts which are connected to legal and financial banking services will lead to a new technological revolution.

|

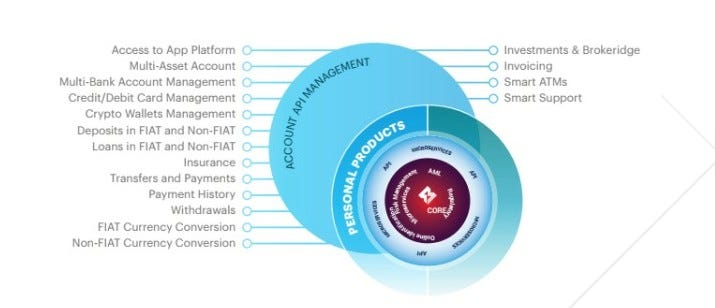

Figure 1 below presents the range of products and services that will be offered by Forty Seven Bank to private persons Innovative products for everyone

The featured product is a Multi-Asset Account for private customers with a tied card.

Propositions for business

Business products oriented towards small and medium-sized enterprises.

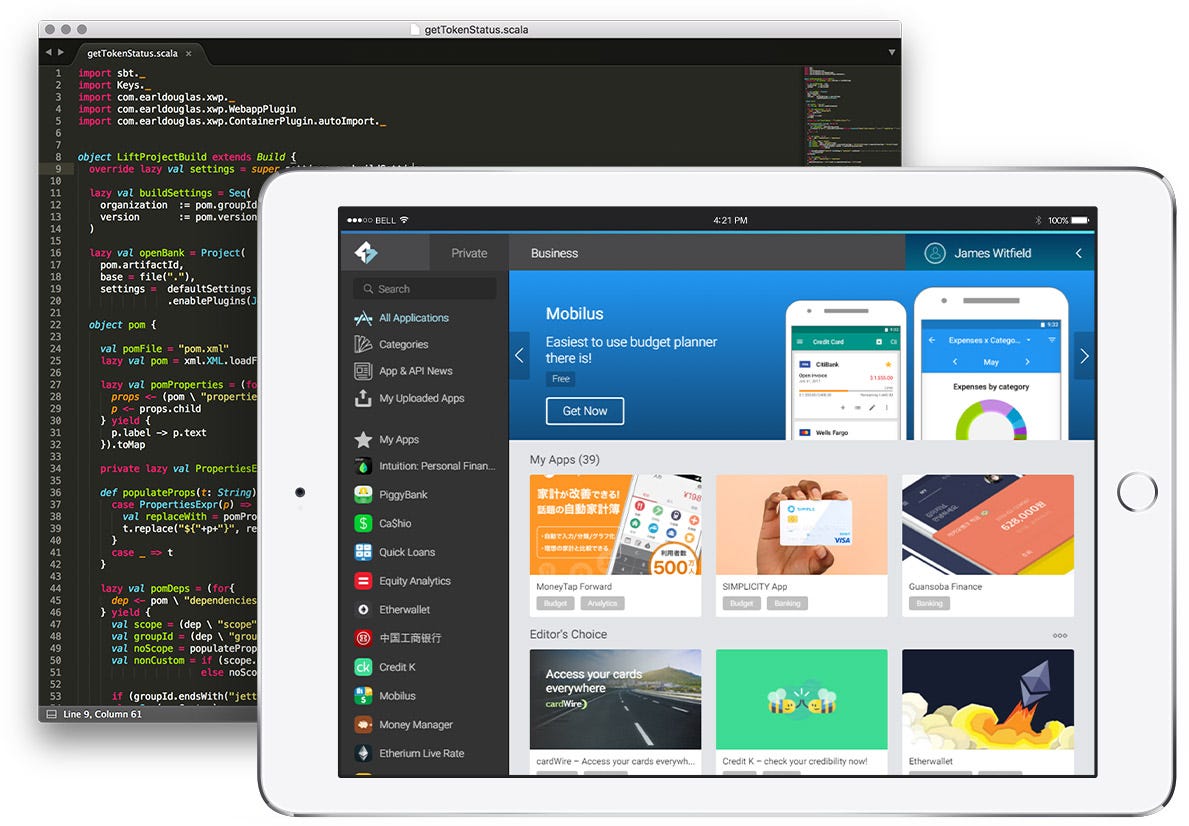

Tools and services for external developers

Technologies and Features

Based on the possibilities of the banking and cryptocurrency industries, we will take the best of the two spheres using innovative and proven technologies in the fields of finance, analytics, and data security.

Forty Seven Bank will provide open, flexible and well-documented API covering the majority of banking services. We will launch our own financial application platform that uses our API. By attracting clients and external developers, we plan to turn it into an efficient ecosystem with constantly growing value.

Application of smart contracts to automate financial processes, thereby enabling us to make deals and give credits with no risk of fraud. The implementation of machine learning technology will allow the creation of a personal manager to foresee all wishes of the client. A virtual interlocutor will assist in the reallocation of cash flows and will provide timely current financial information.

Biometric technologies and blockchain will enable users to open an account distantly and access it via smartphone and ATM without using a card. In combination with cryptographic encryption, these developments will provide increased security of personal and payment data.

Emission of Tokens

What is a Forty Seven Token: It’s a token that represents a part in Forty Seven Bank’s infrastructure and grants the wielder a priority place in the bank’s loyalty program. Holders of FSBT tokens have the right to receive yearly bonuses in the form of FSBL — Forty Seven Bank loyalty tokens. Besides that, FSBT tokens are a crucial economic part of Forty Seven Bank’s ecosystem — they will be needed in order to access the full range of products and services. After the crowdfunding campaign is finished, FSBT tokens will be available for trade at various cryptocurrency exchanges.

What is a token used for: 20% of the bank’s annual net profit will be invested into the loyalty program. Using smart contracts, each FSBT token holder will be able to receive their FSBL tokens based on the amount owned and afterward, exchange the FSBT tokens for different goods offered by the loyalty program (electronics, household items, airplane tickets, banking services, insurances, etc.). All FSBT token holders will receive the right to participate in Forty Seven Bank’s yearly crypto community development program and decide which projects will be supported by the bank and its shareholders.

Abbreviation : FSBT.

Control over emission: is provided by the system of interconnected smart contracts.

Rate: Fixed, value of one token — 0.0047 ETH.

Maximum amount of tokens to be generated: 11 063 829 FSBT (incl. bonus tokens, tokens for bounty and founders).

Minimum budget to start the project: 3 600 ETH (1M EUR).

Hardcap: 36 000 ETH (10M EUR).

Accepted cryptocurrencies on ICO: ETH, BTC.

ICO round 1: November 16 — December 16, 2017.

ICO round 2: December 17 — February 28, 2018.

ICO round 3: March 1 — March 31, 2018.

Token Distribution |

Team

Advisors

Details Information :

Website :https://www.fortyseven.io/

Twitter :https://twitter.com/47foundation

Telegram :https://t.me/thefortyseven

Profile Bitcointalk : https://bitcointalk.org/index.php?action=profile;u=1273699

Komentar

Posting Komentar